Let the Fun Begin!

In theory, adding a new account to the General Ledger is very easy. Easy enough for you to get yourself in trouble if you don’t know what you are doing! There are many things to consider, including number structure, default options, and financial reporting implications. If you have ever taken a look at a main account in D365 Finance, you may wonder why there were so many fields and fast tabs. 🤨 In the first article of this series, we briefly discussed how main accounts play into the chart of accounts. In this post, we will take a deeper dive into the main accounts, and give you the confidence you need when setting up a COA, or adding a new account. Specifically, we will look at how to set up a main account, and all the fields that can be configured to control the behavior.

Setting up a new Account:

If you are working on a new implementation and adding a full chart of accounts, or just adding a new main account, your head might spin looking at the main account screen. There are six fast tabs and 30 fields for only one account! 🤯 No worries, we are going to walk through the common tabs and fields so you can utilize the system to its fullest potential.

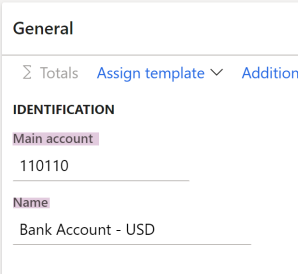

General Fast Tab

| Field | Comments |

|---|---|

| Main Account | The numbering structure needs to be scalable, business model, and future plans should also be taken into consideration. Here are a few tips to keep in mind when numbering your main accounts – Typically you see account numbers range from 4 to 6 numbers -Larger companies with a taller COA, will want to have more digits to account for growth. -Including a totaling account in the number structure can be helpful for integrated financial reporting options. -Some ISV’s work best with a header. If there are future plans to add additional reporting options, this is something to keep in mind. -Financial dimensions can be utilized to keep the number structure flatter than previous versions of a COA that may have needed a different account for each department, or region. |

| Name | This is the name associated with the account. It is recommended to keep naming conventions consistent and similar in size. Here are some examples: – Start each letter with a capital -Headers can be in CAPS |

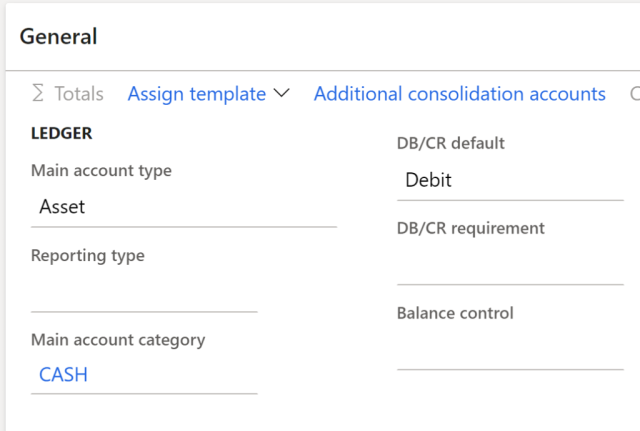

| Field | Comments |

|---|---|

| Main Account Type | There are 10 different main account types, that determine how that account will behave in the system. We will look at those more closely later in this article |

| Reporting Type | This is used when the Main Account Type is set to Reporting. There are 3 different header options for how data is displayed on financial statements -Header- Account information printed at the top -Empty Header- Print an empty row at the top -Page Header- Print at the top of each page |

| Main Account Category | There are 26 OOB options to choose from that are linked to default financial reports |

| DB/CR Default | Set the column you want the cursor to appear in to match the natural balance of the account. |

| DB/CR Requirement | If you have an account that is only used for either debits or credit, you can use this parameter to identify which, and it will be validated and required to post accordingly. This is great to help prevent users from booking entries wrong and can help a consultant make sure the system is set up to meet the clients’ requirements. |

| Balance Control | If an account should have a total balance that is either a debit or credit, this parameter can set a validation point to ensure the sum of the transactions meets that requirement. This helps let someone who is working with the closing and financials that something is not correct, and flags them to find and correct and mistakes. You can’t fix a problem if you don’t know it exists, so this is great to ensure quality control in financial reports! |

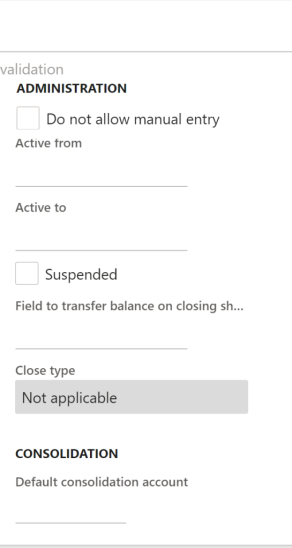

| Field Name | Comments |

|---|---|

| Do not Allow Manual Entry | Set this checkbox to yes for all accounts that are used in the posting profile. This will ensure that the subledger and ledger stay in balance. – When you are importing the GL history balances before a Go-Live you will need to switch these to allow manual entry, and then just change them back when you have posted your balance journals. |

| Active to & Active From Date Range | If you use these date boxes, then only entries dated within that time frame will be validated and posted. |

| Suspended | If you check this box, no transactions can be posted to the account. It will override the active date range setting |

| Transfer Balance on Closing Sheet | Set this checkbox to yes for all accounts that are used in the posting profile. This will ensure that the subledger and ledger stay in balance. – When you are importing the GL history balances before a Go-Live you will need to switch these to allow manual entry, and then just change them back when you have posted your balance journals. |

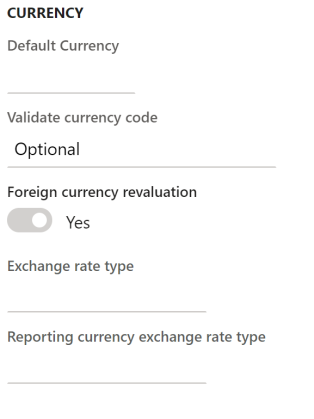

| Field | Comments |

|---|---|

| Default Currency | Select the currency that will default when that main account is used. You can override the default if needed |

| Validate Currency Code | Select if the currency code is required or optional. |

| Foreign Currency Revaluation | Identify if this account will be included when the GL Foreign currency revaluation is done during a periodic close. You will still be able to incorporate the account if you set this to no, but it will take some manual effort. |

| Exchange Rate Type | Select the default exchange rate used during GL FX Revaluation |

| Reporting Currency Exchange Rate Type | Select if you want to use a different exchange rate for the reporting currency used for FX revaluations. |

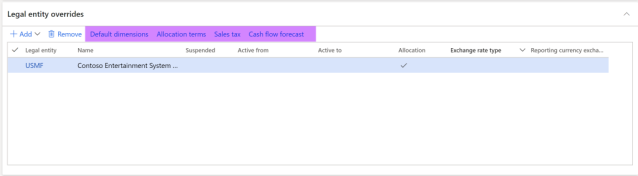

Legal Entity Fast Tab

This fast tab allows the account to have default attributes on a company level. You can add default financial dimensions, set the account up for allocation, fix sales tax codes, or identify forecast allotments, from this tab. If you have more than one company, you can also determine which company has a unique attribute. Let’s take a how to set these features up on the Legal Entity Override tab.

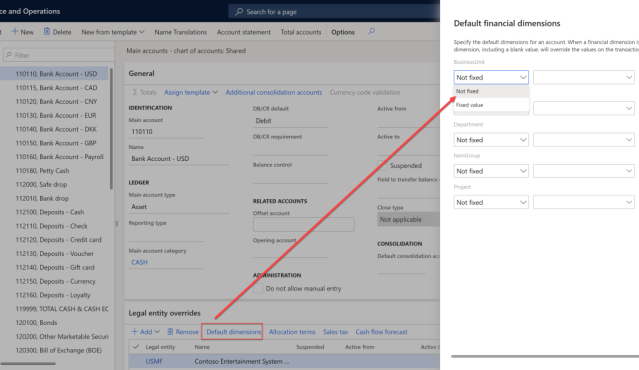

Financial Dimensions

- By selecting the Default Dimension link, you can identify what to default, and if changes can be made.

- Fixed- Can’t be changed by the user when keying.

- Not Fixed- Can be changed by the user if needed when keying.

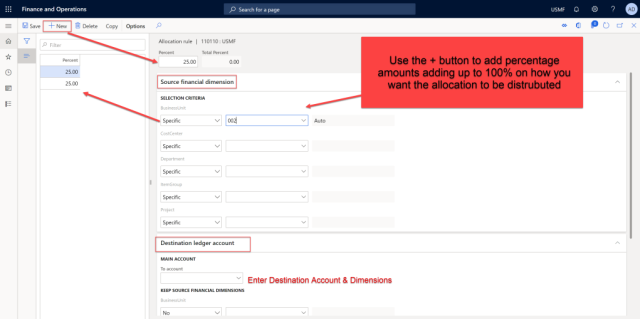

Allocation Terms

- You can set up main accounts to automatically allocate to a specific rule by checking the allocation box and creating the allocation terms.

- You will select the source and can identify to pull precise financial dimensions, or lack of dimensions with the Specific, Not Specific drop-down box.

- You will also determine the destination and the percentage. You will create the different portions of the allocation until you have reached 100%

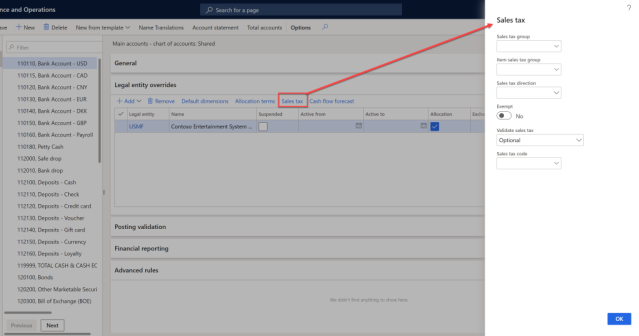

Sales Tax Codes

You can set up Sales tax codes, item groups, and tax directions associated with the main account. Additionally, you can set up what type of validation options, if any, are required for the sales tax codes for that account.

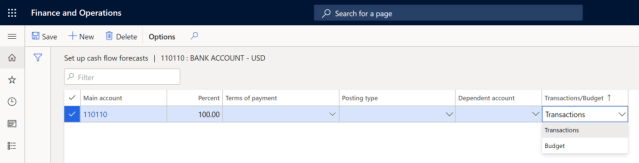

Cash Flow Forecast

- On accounts that will be used for cash flow forecasts, you can identify the percentage to allocate.

- You can also select if any accounts will be affected by transactions in that specific account.

Posting Restrictions Fast Tab

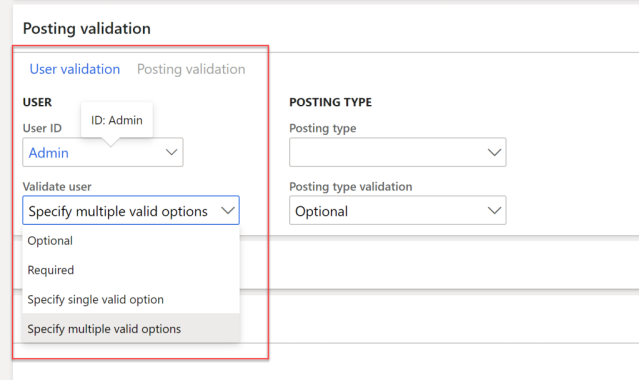

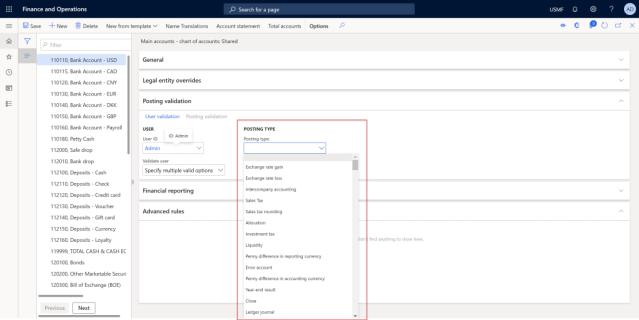

This tab allows you to restrict who or what type of transactions can be posted using the associated main account.

- User restriction: you can control who can post the account by specifying the user in the drop-down box. You can also indicate what level of validation is required; optional, required, single user, or multiple users.

- Posting type: You can control the transaction type associated with the account. For example, for accounts related to sales tax codes, you must list that it is used for Sales tax under the Posting type. Again, you can indicate the same validation scenario as user validation rules.

Financial Reporting Fast Tab

This tab identifies what type of exchange rate should be used on the account when currency exchange, and translation is done in Management Reporter

Exchange Rate- same as exchange rate types set up in system

Translation rate

- Current- Uses the same rate as the date of the report and is used for balance sheets

- Average- Used the average of the exchange rates over the period, and is used for P&L accounts

- Weighted Average-Uses a weighted average based on the days in effect, and is used for P&L accounts.

- Transaction Date- Uses the rate for the date when the transaction was posted. This is used for R.E., and long termdcaff6 equity accounts, such as Fixed Assets.

Is it over yet??

To be fair, I warned you that setting up a main account was much more involved than expected! That is part of my love/hate relationship with #D365Finance; there is a lot of mighty bells and whistles hidden in a sea of fields. This blog doesn’t even cover all of the options, and fast tabs, just a majority of the ones I have typically seen used. Just walking through the tabs proved to be enough content for one post. In my next blog, we will take a look a the main account types and categories as promised.