Where to begin?

One of the most important aspects of a financial system is the chart of the accounts. It is also one of the first places that you need to start when configuring D365 Finance. This article is a 10,000-foot view of out of box capabilities, relevant to a consultant or end-user. I’m excited to share a series of articles that will dive deeper into each functionality. I hope that my experiences will be beneficial to those new to consulting, needing to gain a deeper understanding, in a quick amount of time.

Intro to the Chart of Accounts in D365

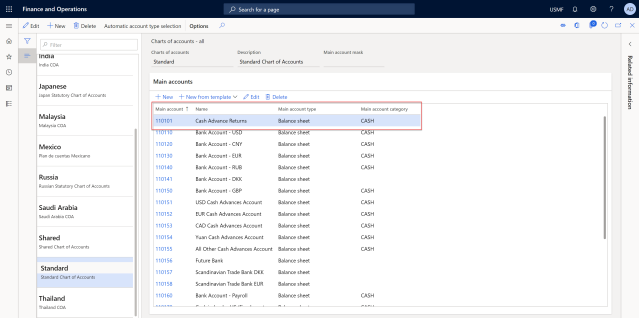

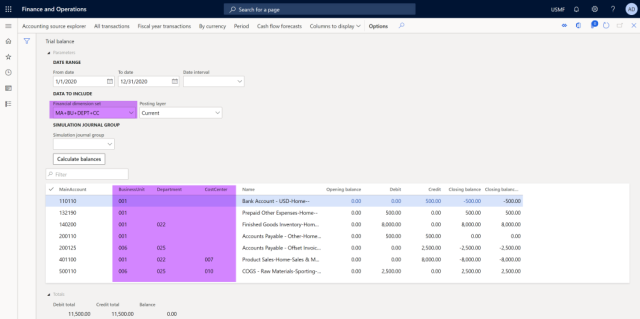

The chart of accounts (COA) is an index of accounts in the general ledger that identifies how those accounts link to financial reports. D365 Finance lists the number, name, type, and category of a main account.

[NAVIGATE: General Ledger> Chart of Accounts> Accounts> Chart of Accounts.]

The COA is all about grouping, similar revenues, expenses, etc., to meet the financial reporting needs for internal decisions and audits. It should also be reviewed by a CPA, as it will need to meet audit standards as well. An organization may have one chart of account for each legal entity or have a shared COA across all the entities. The main parts that impact the COA in the system are Main Accounts, Financial Dimensions, and Account Structure.

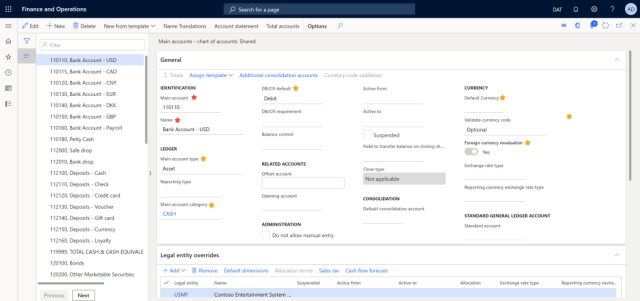

Main Accounts

Main accounts are general ledger transactions, balances, or totals that are associations to accounts on the financial reports. The system requires a number, name, and type, but it’s also a good idea to at least fill out the main account category to link to default financial reports. There are many other options you can set up as defaults such as currency, debit/credit defaults, financial dimensions, exchange rate types if manual entry is allowed, and many other options. They will enable the system to meet specific company requirements.

[NAVIGATE: General Ledger> Chart of Accounts> Accounts> Main Accounts]

🟡= nice to include

Financial Dimensions

Financial dimensions are a compelling feature of D365 Finance. They allow you to further breakdown, track and analyze various parts of the COA. Most commonly, financial dimensions categorize different types of revenue and expenses. For example, there might be a need to record income by product, product type, or maybe customer group, etc. You can also use Financial Dimensions to track projects, regions, and many other useful groups. The benefit is that you can review reports automatically by various dimensions, instead of having to perform excel surgery. The options and flexibility of financial dimensions are limitless!

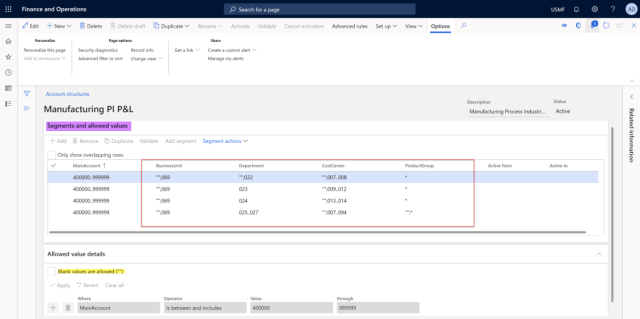

Account Structures

Configuring the account structures is the process of identifying which dimensions can be used on specific account ranges. For example, you may want to look at the product, and item group for revenue and cost accounts, and department for OPEX expenses. You can identify the order you wish to see the main account and financial dimensions. Additionally, you can provide more structure by having specific business rules and values that are allowed for each segment based on the previous dimension. This allows the end-user who is keying various entries to ensure accuracy and efficiency. More so than outdated systems that do not have this extra functionality.

[NAVIGATE: General Ledger> Chart of Accounts> Structures> Configure account structures]

How will this help?

The big winner of this sophisticated general ledger organization is the ability to produce supreme financial reports for both decision making and legal purposes. Main accounts are the basic building blocks of the general ledger in most ERP systems. They can be sliced and diced for various recording purposes by using financial dimensions. In order to prevent extra work correcting transactions booked to the wrong account due to a user’s judgment error, the account structure can be configured to allow only desired ranges based on the main account, or proceeding dimensions. A central feature of D365 Finance is how easily the chart of accounts can be configured to meet extensive business needs across a multitude of industries.

To learn more in-depth details, tips, and tricks on main accounts, financial dimensions, and account structures in D365 Finance stay to this series and use the advice in your day to day tasks, or when configuring a new system. 👩💻👨💻